All Categories

Featured

If you're going to use a small-cap index like the Russell 2000, you could wish to stop and take into consideration why a good index fund business, like Vanguard, doesn't have any type of funds that follow it. The reason is due to the fact that it's a poor index.

I have not even resolved the straw guy here yet, which is the fact that it is relatively rare that you actually have to pay either taxes or significant commissions to rebalance anyway. I never ever have. A lot of intelligent financiers rebalance as much as possible in their tax-protected accounts. If that isn't rather sufficient, early accumulators can rebalance purely making use of new payments.

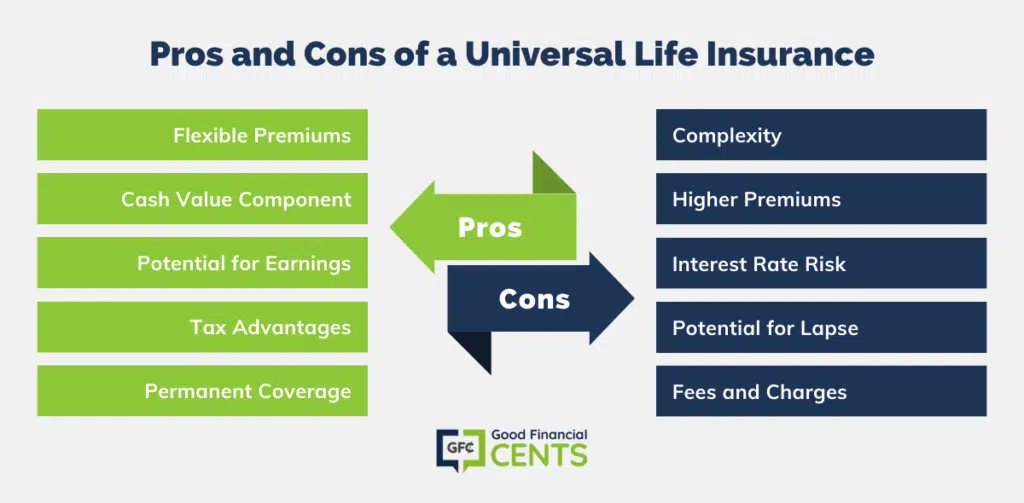

Universal Life Guaranteed Death Benefit

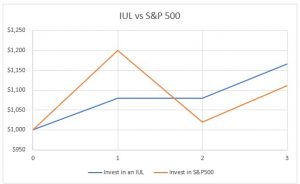

And of training course, no one should be purchasing crammed mutual funds, ever before. It's actually as well bad that IULs do not work.

Latest Posts

Net Payment Cost Index Life Insurance

Adjustable Life Insurance Vs Universal Life Insurance

Difference Between Universal Life Insurance And Whole Life Insurance