All Categories

Featured

If you're going to use a small-cap index like the Russell 2000, you could desire to stop briefly and take into consideration why an excellent index fund business, like Lead, doesn't have any type of funds that follow it. The reason is because it's a lousy index.

I haven't even addressed the straw guy below yet, and that is the fact that it is fairly rare that you really need to pay either tax obligations or substantial payments to rebalance anyhow. I never have. The majority of smart capitalists rebalance as much as possible in their tax-protected accounts. If that isn't rather adequate, very early collectors can rebalance totally using brand-new payments.

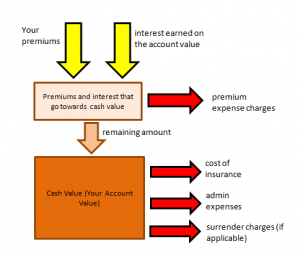

Smart Universal Life Insurance

And of course, nobody ought to be buying packed shared funds, ever. It's truly also bad that IULs do not function.

Latest Posts

Net Payment Cost Index Life Insurance

Adjustable Life Insurance Vs Universal Life Insurance

Difference Between Universal Life Insurance And Whole Life Insurance